Coca-Cola KO published its results on October 24. Here’s Morningstar’s take on Coca-Cola’s results and the outlook for its stock.

Morningstar Key Metrics for Coca-Cola

What we thought about Coca-Cola’s profits

Coca-Cola reported slightly better-than-expected third-quarter results, with organic revenue up 11% (below our estimate of 10%), while adjusted earnings per share growth of 7% matched to our expectations.

Coke increased its 2023 organic revenue and adjusted EPS growth guidance to 10%-11% (from 9%-10%) and 7%-8% (from 5%-6%), respectively. We view this target as achievable and are adjusting our own estimates for 2023 to align with the improving outlook. Our 10-year projections for mid-single-digit sales growth and average operating margins below 30% remain in place.

The results reaffirmed our confidence in Coca-Cola’s competitive position and long-term prospects. Despite a 9% price increase over the quarter (10% year-to-date), volumes (up 2%) held up well, which we attribute to consumer-centric innovations (in recipes, ingredients and packaging), deeper investments in brands (60% digital) that resonate with consumers and astute in-market execution (including region-specific pricing and marketing events, as well as investments in coolers and in-store displays in emerging markets).

Management has emphasized its priority of preserving volume growth (even in hyperinflationary markets like Argentina and Turkey), indicating a clear focus on the long-term value proposition, which we view as prudent. Coke shares are trading below our fair value estimate, and we suggest long-term investors consider buying this name.

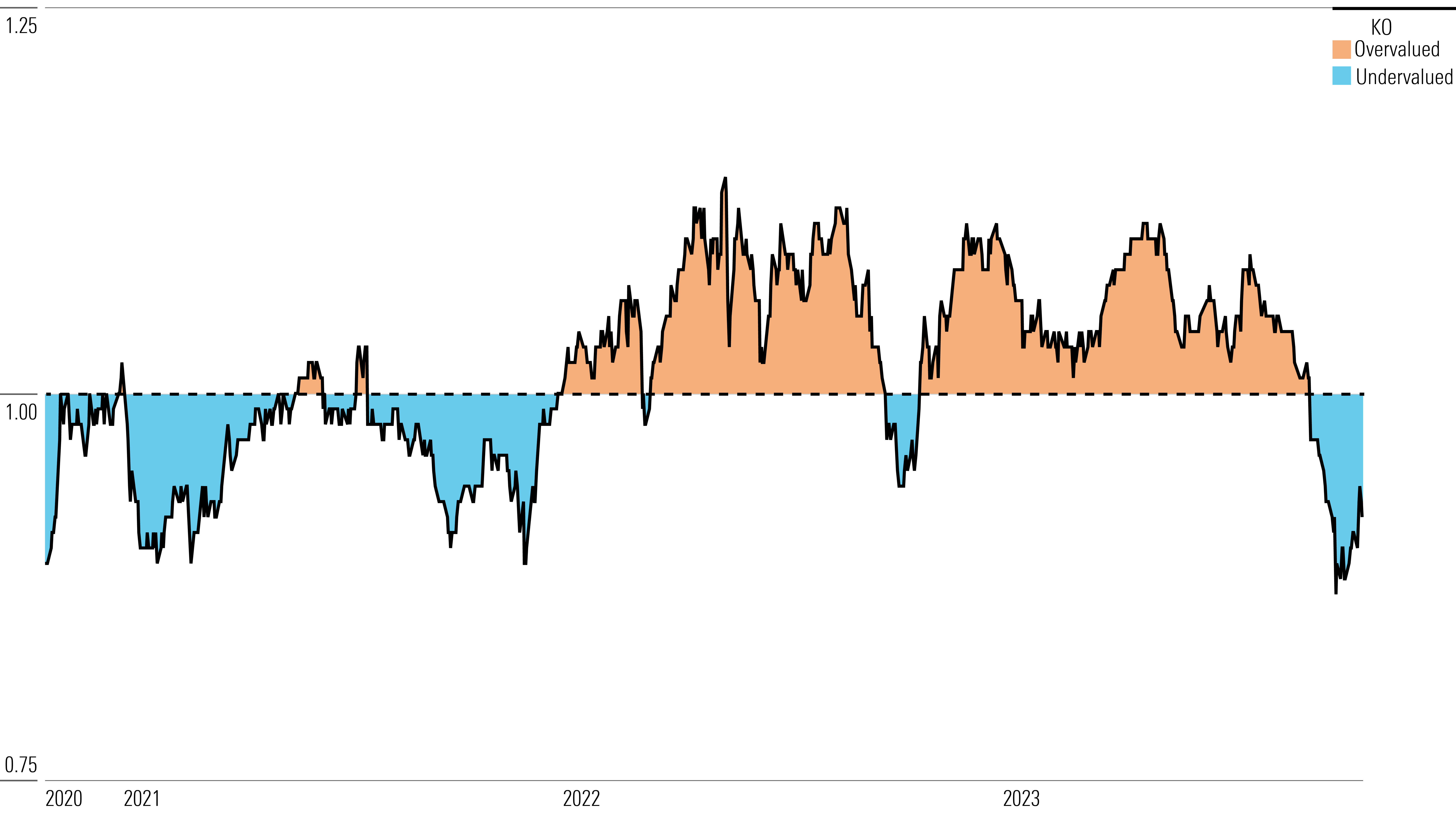

Estimated fair value of coke stock

With its 4-star rating, we believe Coke’s stock is undervalued relative to our long-term fair value estimate.

We are increasing our fair value estimate to $60 per share from $58 to account for better-than-expected results in the first half of 2023 and the time value of money. In the first six months, Coca-Cola increased its price mix by 10% (ahead of our high single-digit growth assumption) and still managed to keep its volume stable (up 1%), thanks to product innovation and strong market execution in both premium and value offerings.

Strong sales trends, coupled with disciplined spending and moderate raw material cost inflation, have led us to raise our 2023 sales and EPS forecasts by 1.6% and 2.0% respectively. Our updated fair value estimate implies a multiple of 22 times to our 2024 adjusted earnings estimate and a 2023 enterprise value/adjusted EBITDA multiple of 19 times. We continue to forecast earnings growth in the mid-single-digit range and high-single-digit range over our explicit 10-year forecast period.

Learn more about Coke’s fair value estimation.

Economic moat assessment

We give Coke a wide economic moat. We expect its impressive brand portfolio (which supports its pricing power and strong relationships with retailers), coupled with the scale advantages arising from a massive global system, to strengthen its competitive position in the market soft drinks and generates excess returns on investment.

We believe Coke has built a broad economic moat around its global beverage business, based on strong intangible assets and a significant cost advantage that will enable the company to generate investment returns in excess of its cost of capital over the of the next 20 years. We modeled the company to generate returns on invested capital averaging 34% over the life of our explicit 10-year forecast, far exceeding our estimate of its weighted average cost of capital of 7%.

As the world’s best-known beverage company, Coca-Cola has a strong portfolio of historic and iconic brands that resonate with consumers, making its products the beverages of choice for drinking occasions at home and on the go. the exterior. The special connection that Coke cultivates and maintains with generations of consumers has allowed it to dominate the carbonated soft drinks category at the heart of its business (69% of the unit volume of cases sold by the company in 2022). As witnessed Summary of drinks According to the data, Coca-Cola holds a convincing lead in its category with a unit case volume share of 46.3% in the US market in 2021, more than 20 percentage points ahead of its main competitor PepsiCo. DYNAMISM (share of 25.6%).

Learn more about Coke’s moat rating.

Risk and uncertainty

We give Coca-Cola a low uncertainty rating.

We view strong relationships with bottlers as critical to its business model and performance profile, but in times of high inflation these relationships could come under pressure as bottlers tend to bear the brunt of cost increases . This issue is less problematic in the United States, where local bottlers are small and have limited bargaining power. But in emerging markets – which hold the key to healthy volume growth – Coke faces much larger bottlers, such as Arca Continental and Coke Femsa, which are likely in a better bargaining position.

Although demand for soft drinks tends to resist economic cycles, Coca-Cola is heavily exposed to international markets (more than two-thirds of its revenues and profits), leading to increased volatility within its operations. , resulting from evolving macroeconomic and regulatory landscapes, exchange rate changes. fluctuations and geopolitical risks, compared to its domestically focused peers. Management’s international experience, combined with bottler collaboration globally, can help the company meet these challenges.

Learn more about the risks and uncertainty associated with Coca-Cola.

KO bulls say

- Coke can leverage strong bottler relationships in underpenetrated emerging markets to drive volume growth with both classic recipes and new products tailored to local tastes.

- Massive investments in a digitized supply chain and data analytics have better aligned Coke and its bottlers in product planning, manufacturing and go-to-market strategy.

- As Costa recovers from pandemic-related disruption, this should help Coke gain a stronger foothold in the coffee category and provide more information to consumers, given its global footprint.

KO bears say

- Persistent headwinds for soft drink demand in developed markets pose a challenge to Coca-Cola’s long-term growth prospects.

- The company’s brand portfolio and product range in non-sparkling categories are less strong and heavy investments are required to strengthen its competitive position.

- With two-thirds of its revenue coming from international markets, Coca-Cola faces constant currency fluctuations that lead to volatility in reported profits.

This article was compiled by Tom Lauricella.