Employer-provided health coverage is important for recruitment, but even more important for retention.

A new survey shows that:

- 56 percent of U.S. adults with employer-sponsored health benefits said whether or not they like their health coverage is a key factor in their decision to stay in their current job.

- 46 percent said health insurance was either the deciding factor or a positive influence in choosing their current job.

“We were surprised to see such a high percentage of American workers who emphasized the importance of health coverage in choosing and maintaining their jobs,” said Phillip Morris, vice president of Luntz Global Partners, who conducted the survey for US health insurance plans. AHIP), a trade association for health insurers.

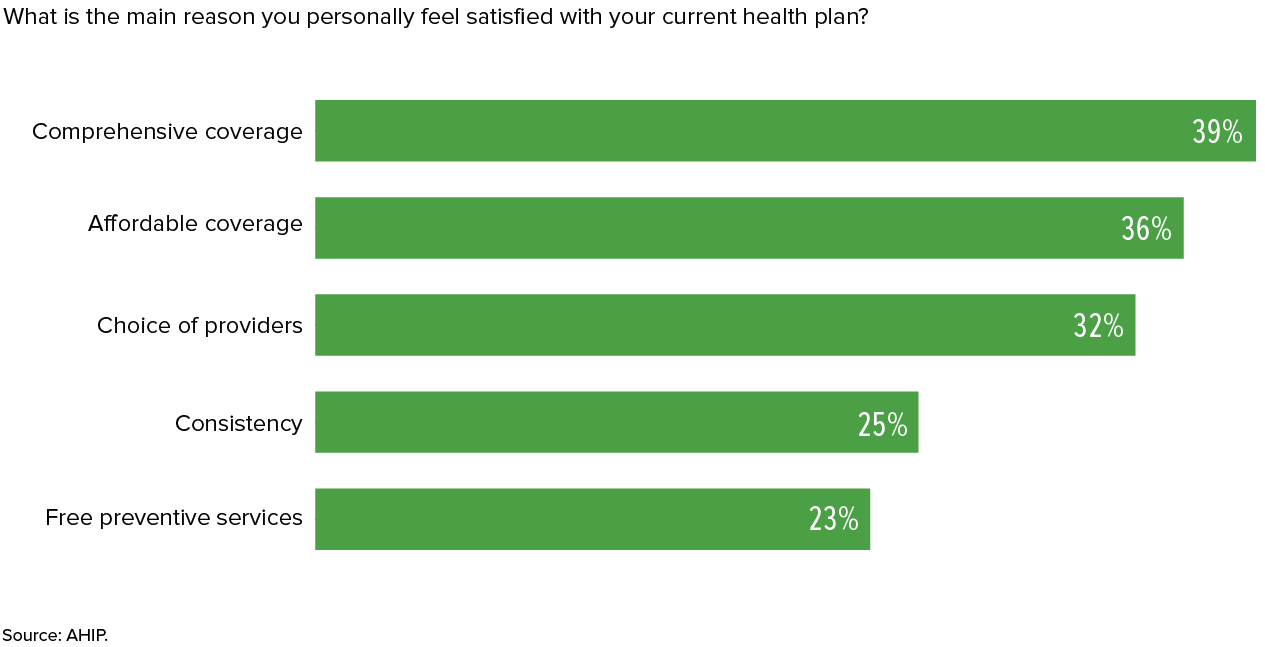

THE survey results showed that 71 percent of employees are satisfied with the current coverage provided by their employer, but that high costs worry many.

Responses were collected Jan. 25-28 from 1,000 U.S. adults receiving health care at their workplace. The results were published on February 6 expert panel event in Washington, DC, sponsored by AHIP and the nonprofit Bipartisan Policy Center.

Satisfaction driven by coverage, cost and choice

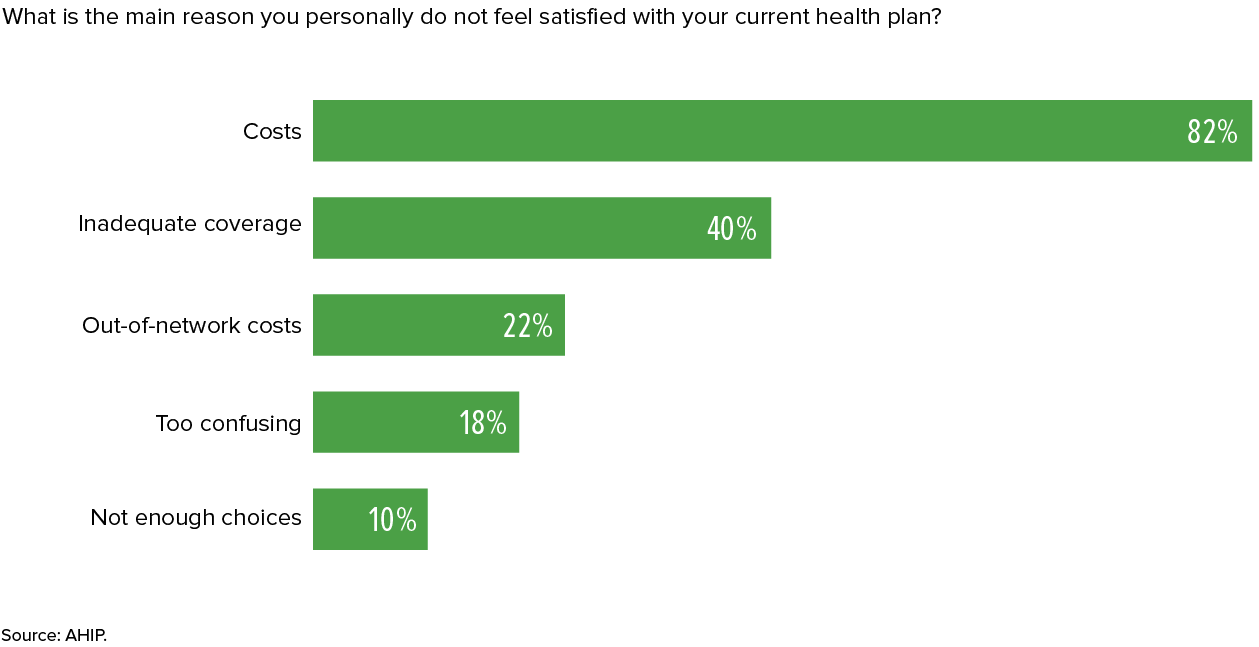

But:

Costs are the main driver of dissatisfaction

Among other discoveries:

- Most workers (71%) remain concerned about the continued rise in the cost of their health plans.

- The benefits that matter most to them are prescription drug coverage (cited by 51 percent of respondents), preventative care (47 percent) and emergency care (47 percent).

Foster innovation

“Employer-provided insurance is the cornerstone of the U.S. health care system, covering more than 150 million Americans and driving innovation that helps improve the overall health care market,” said David Cordani, Chairman and CEO of Cigna, who spoke at AHIP/Bipartisan. Rules Information Center event. “Employer-provided coverage helps employers create localized health communities to help their employees stay healthy and productive, while pursuing targeted innovation that meets their unique needs.” »

“Large employers are pushing the boundaries by improving access to high-quality care and encouraging employee engagement with their health benefits,” said Brian Marcotte, president and CEO of the National Business Group on Health, a nonprofit employer group, during a roundtable discussion.

He highlighted recent success in the growth of telehealth and virtual health coaching services, which have changed the way chronic illnesses are managed.

“Five years ago, 14 percent of large companies offered telehealth services to their employees,” Marcotte said. “Today, 96 percent of large companies offer telehealth.” Additionally, more than half now offer remote behavioral health consultations for mental health concerns, “which is a 50% increase from last year.”

Listening to employees

“You have to know your employees and what they expect” from their health benefits, advised Paula Harvey, SHRM-SCP, vice president of human resources at Schulte Building Systems, a metal building manufacturing company employing 600 people in Hockley, Texas. “Don’t sit in your office looking at claims numbers. Go out and talk to your employees, find out what works for them. »

Harvey, who represented the Society for Human Resource Management at the roundtable, is a member of the SHRM Foundation Board of Directors and has served on SHRM’s Southeast Member Advisory Council.

“Find innovative ways to start the conversation (about health),” Harvey said. “My employees can participate in well-being challenges themselves” and monitor their progress online. “We are setting up walking paths” to encourage employees to get out and move during lunch or before and after work.

“It’s difficult for employees to take time off work to take advantage of their health benefits,” she noted. “We all have sick days that we can use, but if we are considering increasing vaccination rates or primary care visits, why not offer individuals ‘health days’ so that they can access preventive care services,” giving workers the flexibility to use their benefits.

Getting management involved in health promotion initiatives at his company wasn’t hard to convince, Harvey noted. “CEOs care about the health of their employees as their employees show up to work.”

(SHRM Members Only Toolkit: Managing healthcare costs)

Apply Value-Based Designs

Value-based design (VBD), which “spends more on things that make people healthier and less on things that don’t” is increasingly part of health plans that employers self-fund, but laws and regulations have hindered its broader use, said Mark Fendrick, MD, director of the Center for Value-Based Design at the University of Michigan.

He favors insurance paying a greater share of the cost of services “when the evidence of their effectiveness is strong” – such as that noted by clinician organizations participating in Choosing Wisely initiative– “and increases the cost of services for which there is little evidence of effectiveness.”

“We need to integrate VBD into health savings accounts, which I like, but which are tied to high-deductible health plans, which are not nuanced or flexible,” Fendrick said. He urged changing government policies to give HDHPs the flexibility to cover high-value services outside of the franchise so “people don’t have to have a bake sale to access the services they need” .

He described the heartbreaking emails he receives from employees saying, “Thanks for the free mammogram, but I can’t meet the deductible for my mastectomy” or “Thanks for the hepatitis C screening, but I can’t not pay.” I don’t have access to therapy.”

He added: “Unfortunately, many patients diagnosed with HIV through free testing really struggle to afford potentially life-saving therapies. »

Looking ahead, “we can turn HDHPs into high-value plans,” Fendrick said. “We need to overcome the government’s political inertia to achieve this.”

The recently introduced Chronic Disease Management Act 2018for example, would amend the IRS tax code so that high-deductible health plans associated with HSAs can cover chronic disease prevention and treatment on a pre-deductible basis.

Related SHRM article:

High-deductible plans are more common, but so are the choices, SHRM online Social benefits, February 2018

Was this article helpful? SHRM offers thousands of tools, templates, and other member-exclusive benefits, including compliance updates, sample policies, HR expert advice, education discounts, community growing online membership and much more. Join/Renew Now and let SHRM help you work smarter.