Adopting legislation, regulations and standards that promote sustainable and more equitable development is essential to solving sustainability problems. One obstacle is corporate lobbying to mitigate, or even thwart, effective policy changes. We invite other investors to join us in intensifying their engagement with companies on this important topic.

The effects of corporate lobbying have become evident in recent years when it comes to climate change. Extensive research by InfluenceMap, an independent non-profit think tank, has revealed how. Its findings were incorporated into the Net Zero Corporate Benchmark published by Climate Action 100+ (CA100+), widely used by investors to assess and interact with companies on this topic.

In recent years, we have engaged with many large emitters to ask them to align both their direct lobbying and that of the industry associations to which they belong (known as indirect lobbying) with the objectives of the Paris Agreement in accordance with the Global Standard on Corporate Climate Lobbying. We launched this standard in 2022 with AP7 and the Church of England Pensions Board. We have had substantial success (see pages 46-47 of our 2021 Global Sustainability Report).

We are now also tackling another topic where ambitious policy change is clearly needed: food and health.

Advocacy for change – food systems

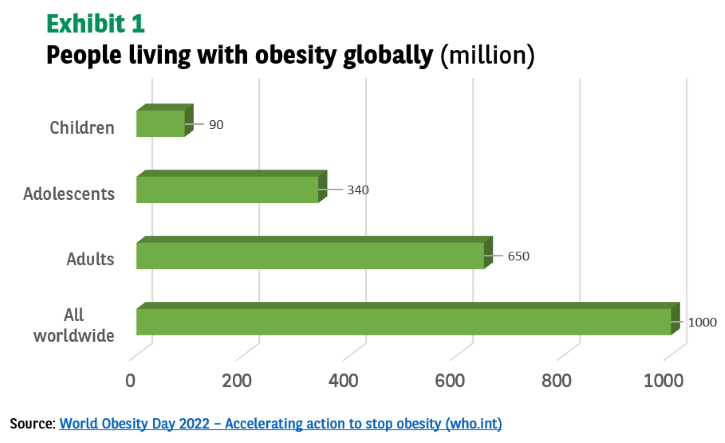

Together, poor diet now causes more disease worldwide than physical inactivity, alcohol and smoking combined.(1) About 2.6 billion people – 38% of the world’s population – are overweight or obese . Among them, more than 1 billion people worldwide are obese – 650 million adults, 340 million adolescents and 39 million children, as shown in Table 1.

If recent trends continue, without widespread adoption of taxes and limits on the promotion of unhealthy foods, these numbers are expected to reach more than 4 billion people (51%) in 12 years, according to research from the World Obesity Federation.(2)

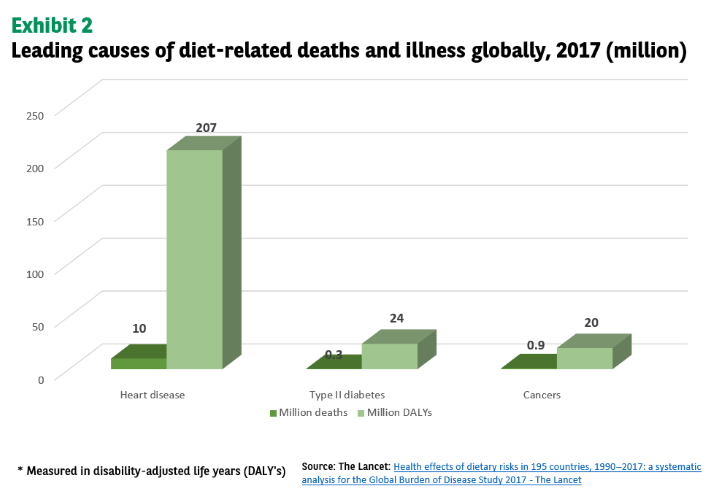

The more overweight a person is, the more likely they are to suffer from a range of diet-related illnesses, including heart disease and stroke, type II diabetes, musculoskeletal disorders and 13 cancers (see Table 2). High levels of diet-related illness harm a country’s economic growth, take up a significant portion of their health budgets, reduce worker productivity across sectors, and impose heavy burdens on individuals and families, especially to those with low income.(3), (4)

Much like climate change, the solution to the global food-related health crisis lies not in individual action, but in systemic change. Narratives that people need to take more personal responsibility and discipline themselves to eat better are gradually being replaced by those that recognize this.

One of the main reasons for poor diet is the lack of access and affordability to healthy, unprocessed foods, with highly processed convenience foods high in fat, sugar and salt being more readily available and less expensive, often supported by grants and the like. policies that distort things.

The World Health Organization and public health advocates have long advocated for policy measures such as stricter front-of-package (FOP) labeling requirements, restrictions on food marketing unhealthy foods aimed at children and fiscal measures such as sugar taxes. Policymakers are increasingly responding to their calls. The World Cancer Research Fund International (WCRF) tracks all these advances in its NOURISH database and earlier this year recorded the 1,000th such policy action in Europe alone.(5)

Hold back the change

However, there is growing evidence that agribusiness companies, directly and through trade associations, are obstructing, preventing and weakening policy proposals. This is even as more and more commit to supporting public health and nutrition and demand sector-wide progress.

As a signatory of the Access to Nutrition Initiative (ATNI) Investor expectations regarding nutrition, food and healthwe were happy that in December 2022, ATNI published a benchmark of the 25 largest food companies in the world in terms of lobbying, management systems and disclosure.

ATNI assessed company practices in relation to Responsible Lobbying Framework (RLF). This provides investors with a starting point to engage with the third pillar of investor expectations.: “Companies should… adopt the five principles and associated management practices set out in the (RLF): legitimacy, transparency, consistency, accountability and timeliness. »

The assessment results are concerning: the average score was 21% across all companies, with individual scores ranging from 3% to 50%. Although the maturity of companies varies considerably, current practice clearly falls short of the standards set by the RLF.

Commit to change

We have started engaging with some of the rated companies held in our portfolios using ATNI results. We want to encourage them to:

- Set high-level commitments to push for public health policy measures

- Translate them into action with effective management systems

- Be open and transparent about their activities through full disclosure.(6)

We urge other investors to join us in amplifying our voice and convincing food companies to push for policy measures to improve diets and public health, and to fully disclose their advocacy activities.

(1) GBD 2017 Diet Collaborators, “Health effects of dietary risks in 195 countries, 1990-2017: a systematic analysis for the Global Burden of Disease 2017 study” (2019) The Lancet 393(10184): 1958-72 https:// /www.thelancet.com/article/ S0140-6736(19)30041-8/fulltext

(2) World_Obesity_Atlas_2023_Press_Release.pdf (worldobesityday.org)

(3) OECD, The heavy burden of obesity: The economics of prevention (2019, OECD Publishing, Paris) https://doi. org/10.1787/67450d67-fr.

(4) World Bank, “The World Bank and Nutrition” (2019) https://www.worldbank.org/en/topic/nutrition/overview

(5) Nutrition in Europe: there is work to be done | WCRF International (6) It is important to note that ATNI’s research was not designed to identify examples of corporate lobbying for nutrition and health policy measures.

Disclaimer

![]()

Please note that articles may contain technical language. For this reason, they may not be suitable for readers without professional investment experience. All opinions expressed herein are those of the author as of the date of publication, are based on available information, and are subject to change without notice. Individual portfolio management teams may have different views and make different investment decisions for different clients. This document does not constitute investment advice. The value of investments and the income they generate may go down as well as up and investors may not get back their initial investment. Past performance does not guarantee future returns. Investing in emerging markets or in specialized or restricted sectors is likely to be subject to above-average volatility due to a high degree of concentration, greater uncertainty due to less available information, less liquidity or greater sensitivity to changes. under market conditions (social, political and economic conditions). Some emerging markets offer less security than the majority of developed international markets. For this reason, portfolio transaction, liquidation and custody services on behalf of funds invested in emerging markets may involve higher risk.

Environmental, social and governance (ESG) investment risk: the lack of common or harmonized definitions and labels incorporating ESG and sustainability criteria at EU level may result in different approaches from managers when defining ESG objectives. This also means that it can be difficult to compare strategies incorporating ESG and sustainability criteria as the selection and weightings applied to selected investments may be based on indicators that may share the same name but have meanings under -different underlying. When evaluating a security based on ESG and sustainability criteria, the Investment Manager may also use data sources provided by external ESG research providers. Given the evolving nature of ESG, these data sources may be incomplete, inaccurate or unavailable at this time. The application of standards of responsible business conduct in the investment process may lead to the exclusion of securities of certain issuers. Therefore, the performance (of the Sub-Fund) may sometimes be better or worse than the performance of comparable funds which do not apply these standards.